Nvidia's Earnings Blowout: Bubble Concerns vs. Future Potential

Michael Burry's Nvidia Warnings: Is He Right, or Is This Just the Start of Something HUGE?

Okay, let's talk Nvidia. Because honestly, the drama is getting good. You've got Michael Burry, the guy who called the 2008 crash, throwing shade at the AI boom, specifically at Nvidia. Then you have Nvidia basically saying, "Nah, we're good," after posting absolutely bonkers earnings. The stock jumps, everyone breathes a sigh of relief… but is Burry right? Is this all just hype, a bubble waiting to burst? Or are we missing the forest for the trees?

A Glimpse Beyond the Horizon

Burry's main beef seems to be that companies are stretching the depreciation of their older chips to make their earnings look better. He argues that just because those older chips are still being used doesn't mean they're actually profitable. He even uses the analogy of airlines keeping old, inefficient planes around just to meet holiday demand—they're squeezing every last drop, but it's not exactly a sign of long-term health. He also points to the "give-and-take deals" between Nvidia, OpenAI, Microsoft, and Oracle, suggesting that the real demand isn't as massive as it seems. True end demand is ridiculously small, he says. 'Big Short' investor Michael Burry takes aim at Nvidia after its earnings blowout

But here’s where I think Burry might be missing the bigger picture, because Nvidia isn't just selling chips, it’s selling a platform. Colette Kress, Nvidia’s CFO, even emphasized that their CUDA software extends the life of their systems well beyond their original estimated lifespan! The A100 GPUs they shipped six years ago are still running at full utilization today. That's not just about squeezing profits; it's about building a sustainable ecosystem.

Think of it like this: it's like comparing the early days of the automobile to the horse-drawn carriage. Sure, you could keep using horses, but eventually, the entire infrastructure—the roads, the gas stations, the mechanics—shifted to support cars. Nvidia is building that infrastructure for AI, and CUDA is the glue holding it all together.

And here's another point: Warren Buffett's Berkshire Hathaway just took a $4.3 billion stake in Alphabet, which is pouring billions into AI infrastructure. Now, Buffett isn't exactly known for chasing tech trends, so this feels like a pretty big vote of confidence in the long-term potential of AI. Is it possible that Buffett and his team see something Burry doesn't? Warren Buffett Just Delivered Incredible News for Nvidia Stock Investors

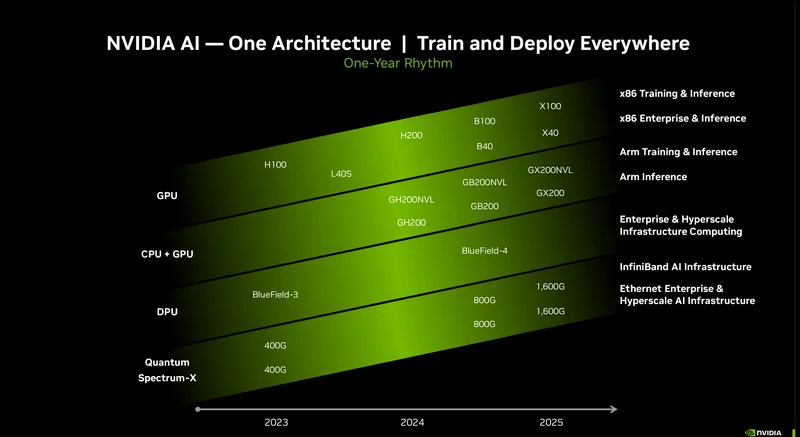

Nvidia's CEO, Jensen Huang, has been adamant that there's no AI bubble, and the company’s actions speak louder than words. They’re not just selling chips; they're selling the picks and shovels for the AI gold rush. And the miners are hungry. Major tech companies are projected to ramp up capital spending by hundreds of billions over the next few years. Goldman Sachs is forecasting over a trillion dollars in capital spending by hyperscalers from 2025 to 2027. Even Alphabet has increased its 2025 capital expenditure estimate from $85 billion to $92 billion.

So, what does this mean for us? Well, it means AI is not just a buzzword. It's becoming deeply integrated into the fabric of our lives. Meta is using AI recommendation systems to keep us hooked on Facebook and Threads. Anthropic expects to earn $7 billion in annual revenue this year. Salesforce's engineering team is 30% more efficient now that it's using AI for coding. The applications are endless, and this is just the beginning.

But before we get carried away, it's important to acknowledge the ethical considerations. With great power comes great responsibility, and we need to ensure that AI is used for good, not for harm. The potential for misuse is real, and we need to have open and honest conversations about the implications.

One question that lingers in my mind is this: As AI becomes more pervasive, how do we ensure that it benefits everyone, not just a select few? How do we prevent the technology from exacerbating existing inequalities?

The Dawn of the AI Age

I'm not saying Burry is wrong to be cautious. Healthy skepticism is essential, especially in a rapidly evolving field like AI. But I believe that Nvidia's success is not just about short-term profits. It's about building a foundation for the future, a future where AI transforms every aspect of our lives. The speed of this is just staggering—it means the gap between today and tomorrow is closing faster than we can even comprehend.

So, is this the start of something huge? I think it is. I really do. And honestly, when I first started seeing the projections for AI's potential impact across industries, I just had to sit back and let it sink in. This is the kind of breakthrough that reminds me why I got into this field in the first place.