Mortgage Rates Today: Seizing the Opportunity in 30-Year & Refinance Trends

Beyond the Numbers: How Today's Mortgage Market Demands a Visionary Approach

Alright, let's talk about something many folks probably see as just a sea of numbers: mortgage rates. But I’m here to tell you, what’s happening in the market right now isn’t just about basis points and percentages; it’s a fascinating, almost poetic, reflection of human resilience and our relentless pursuit of home, a quest that’s as old as civilization itself, and utterly vital to our collective future. When I dive into these reports, I honestly don't just see data, I see the intricate dance between global economics and individual aspirations, a complex adaptive system unfolding before our very eyes!

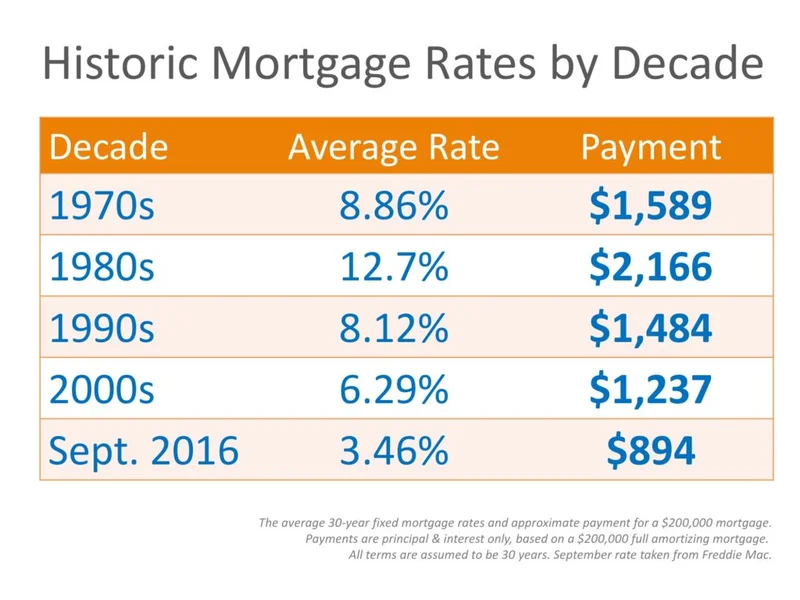

The headlines might scream about rates dipping slightly, and sure, Freddie Mac tells us the average 30-year fixed rate nudged down to 6.23%, with 15-year fixed loans also easing to 5.51%. Zillow’s data even shows the 30-year fixed at a tantalizing 6.04% in some averages. On the surface, it’s a modest shift, a few basis points here and there – or, in simpler terms, tiny fractions of a percent that can still add up to real money over the life of a loan. But here’s the real story, the one that excites me: Sam Khater, Freddie Mac’s Chief Economist, notes that "pending home sales are at the highest level since last November." Think about that for a second. In a market that’s been, let’s be frank, a bit of a rollercoaster, people aren’t just sitting on their hands. They're moving. They're adapting. They're finding ways to make it work. What does this tell us about the fundamental human drive for homeownership? How much innovation, how much strategic thinking, are we seeing in the sheer tenacity of those navigating this landscape?

The Fed's Gambit and Your Digital Compass

Now, let's zoom out a bit. We’ve seen the Federal Reserve cut rates in September and October of 2025, yet mortgage rates, those stubborn beasts, haven’t always marched in perfect lockstep. This isn't some glitch in the matrix; it's a testament to the myriad forces at play. We're talking about everything from the yield on 10-year Treasury notes to oil prices, even the collective investor sentiment reflected in the Fear & Greed Index. It's like trying to predict the weather by looking at a single cloud – you need a broader, more integrated view.

This brings us to the diverging forecasts for 2026. Fannie Mae sees a gradual, optimistic slide, predicting 30-year fixed rates dipping to 5.9% by Q4/26. The MBA, however, is playing it a bit more cautiously, expecting rates to hold steady around 6.4%. Who’s right? That’s not the point. The point is the uncertainty, which, to a visionary, isn't a problem, but an opportunity. It’s a call to arms for informed decision-making.

Remember the early days of the internet? People were skeptical, clung to old ways of doing business. Now, we can't imagine life without it. This current mortgage landscape feels a bit like that – a complex, dynamic environment that demands we leverage every tool at our disposal. We’re in an era where knowing your credit score isn’t enough; it’s about understanding your debt-to-income ratio, exploring VA mortgage rates if you qualify, and critically, using a mortgage calculator to model different scenarios. It’s about being your own financial architect, using data as your blueprint. This isn't just about finding the "best mortgage rates today"; it's about crafting the right strategy for your life.

Unlocking the "Golden Handcuffs" and Reframing Opportunity

There's a term floating around the market right now: "golden handcuffs." It refers to the millions of homeowners who snagged those unbelievably low 2-3% interest rates during the pandemic. They're effectively "locked in," unwilling to move or refinance because new mortgage rates today are, understandably, higher. It’s a perfectly rational economic decision, but it also creates a fascinating societal inertia. What if we reframed this? What if instead of seeing it as a bind, we see it as a powerful, collective anchor of stability that allows for innovation elsewhere in the housing market?

For those not in golden handcuffs, this recent dip, however slight, is a moment to act strategically. Maybe you're a first-time homebuyer, or perhaps you're eyeing a refinance. The data tells us refinance rates today are often a touch higher than purchase rates, but the principle remains: knowledge is power. Should you consider a 15-year fixed mortgage for the long-term interest savings, even with higher monthly payments? Or does the predictability and lower monthly outlay of a 30-year fixed mortgage make more sense for your current budget? Mortgage and refinance interest rates today, November 26, 2025: 30-year rates dip as pending home sales rise.

This isn't just about personal gain; it’s about collective responsibility. As we navigate these waters, we have an ethical imperative to use the information and tools available to us wisely. To not just chase the lowest current mortgage rates, but to understand the long-term implications, the personal financial health, and the broader economic ripple effects of our decisions. We’re not just consumers; we’re participants in a vast, interconnected system.

I've seen some incredible discussions on forums lately, people sharing their creative approaches to negotiating rates, leveraging alternative loan types, and even using the slight dips as a trigger to lock in. It’s not just the big institutions making moves; it's you, the individual, equipped with information and a vision.

The Future is What We Build Together

This isn't a static market; it's a living, breathing entity, constantly shifting. The slight dip in interest rates today isn't just a blip; it's a reminder that opportunities emerge even in uncertainty. It's a chance to reassess, to strategize, and to move forward with informed confidence. The future of homeownership isn't dictated solely by the Fed or market forces; it's shaped by every thoughtful decision we make. It’s about leveraging every piece of data, every expert insight, and every digital tool to chart your own course.